CIMAPRO19-P02-1 Exam Questions & Answers

Exam Code: CIMAPRO19-P02-1

Exam Name: P2 - Advanced Management Accounting

Updated: Apr 25, 2024

Q&As: 202

At Passcerty.com, we pride ourselves on the comprehensive nature of our CIMAPRO19-P02-1 exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free CIMA CIMAPRO19-P02-1 Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your CIMA CIMAPRO19-P02-1 exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free CIMA CIMAPRO19-P02-1 Dumps

Practice These Free Questions and Answers to Pass the CIMA Certifications Exam

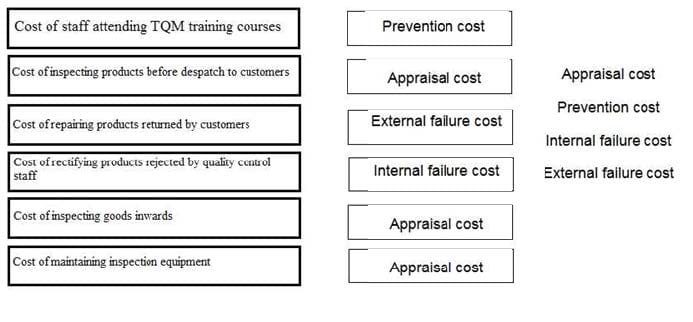

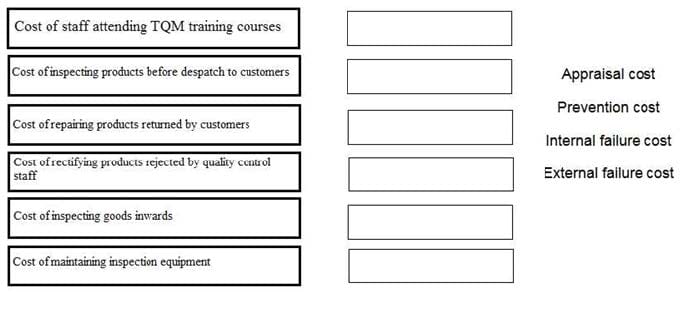

DRAG DROP

Place the correct quality cost classification against each cost described below.

Select and Place:

A machine requires an initial investment of $500,000. The net present value (NPV) of the investment in the machine is $36,500. Which of the following statements is correct in relation to the sensitivity of the investment?

A. The initial investment can increase by no more than 7.3% before the project is not viable.

B. The NPV can decrease by no more than 7.3% before the project is not viable.

C. The initial investment can increase by no more than 13.7% before the project is not viable.

D. The NPV can decrease by no more than 13.7% before the project is not viable.

In an inflationary environment which is the correct way of calculating net present value (NPV)?

A. Using nominal cash flows and a nominal discount rate.

B. Forecasting the cash flows including the effect of inflation and then using a real discount rate.

C. Using real cash flows and a nominal discount rate.

D. Forecasting the cash flows excluding the effect of inflation and then using a nominal discount rate.

A company is investing $200,000 in a project which will generate a cash flow of $60,000 each year for five years starting immediately. The company's cost of capital is 7%. The net present value of the investment to the nearest $100 is:

A. $63200

TTR Ltd plans to purchase a new plant for $1,000m on the 1st of January 20X6. The annual sales expected from the production of this plant is S400m per year. The plant has an expected life of five years. The financial accountant has computed the NPV of the project at $61.42m considering a discount rate of 10%. The marketing director wants to know the percentage drop in revenue that the sales team can afford before the project becomes unviable. Which of the following indicates the percentage required by the marketing director?

A. 4.05%

B. 5.05%

C. 4.5%

D. 10%

Viewing Page 1 of 3 pages. Download PDF or Software version with 202 questions