CIMAPRA19-F02-1 Exam Questions & Answers

Exam Code: CIMAPRA19-F02-1

Exam Name: F2 - Advanced Financial Reporting

Updated: Apr 24, 2024

Q&As: 256

At Passcerty.com, we pride ourselves on the comprehensive nature of our CIMAPRA19-F02-1 exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free CIMA CIMAPRA19-F02-1 Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your CIMA CIMAPRA19-F02-1 exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free CIMA CIMAPRA19-F02-1 Dumps

Practice These Free Questions and Answers to Pass the CIMA Certifications Exam

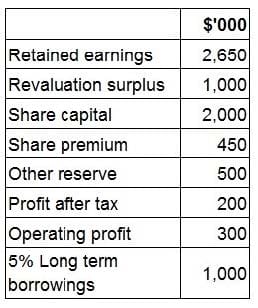

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

A. gearing of 15% and interest cover of 6.

B. gearing of 16% and interest cover of 6.

C. gearing of 15% and interest cover of 4.

D. gearing of 16% and interest cover of 4.

Which THREE of the following would determine the functional currency of an overseas subsidiary in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates?

A. The currency which principally influences selling prices for goods and services.

B. The currency in which operating receipts are retained.

C. The currency that mainly influences labour, material and other costs.

D. The currency which the parent company uses to present its financial statements.

E. The currency in which all non-current assets are purchased and recognised.

F. The currency which principally influences the choice of functional currency of the parent.

Which of the following statements are true regarding consolidated cash flows after the acquisition of a subsidiary?

Select ALL that apply.

A. The subsidiary's cash inflows and outflows become part of the group after purchase

B. Cash acquired from the subsidiary upon purchase is represented as a cash inflow

C. Adjustments need to be made to group working capital in light of the working capital acquired from the subsidiary

D. Net cash paid to acquire a subsidiary is shown as a cash inflow within the cash flow from investing activities

E. Disclosure notes are required to show cash and cash equivalents paid or received, but not details of goodwill, assets and liabilities acquired

F. Further adjustments are required to cash inflows and outflows after profit has been consolidated

Which of the following statements about ST is true?

A. The return on the investment in associate on an annual basis is 14%.

B. The effective tax rate incurred by ST has remained largely the same.

C. The increase in administrative expenses is in line with the increase in revenues.

D. The ratio of distribution costs to revenue has increased significantly.

CORRECT TEXT

CD has 200,000 equity shares with a current market value of $2.50 each. The annual dividend of $0.50 a share is about to be paid.

CD also has redeemable debt with a nominal value of $100,000. This is currently trading at $90 for each $100 of nominal value.

The cost of equity is 20% and the post tax cost of debt is 6%.

What is CD's weighted average cost of capital?

Give your answer in % to one decimal place.

? %

A. 17.4, 17.42, 17.43, 17.40

Viewing Page 1 of 3 pages. Download PDF or Software version with 256 questions