PEGAPCDC85V1 Exam Questions & Answers

Exam Code: PEGAPCDC85V1

Exam Name: Pega Certified Decisioning Consultant (PCDC) version 8.5

Updated: May 10, 2024

Q&As: 60

At Passcerty.com, we pride ourselves on the comprehensive nature of our PEGAPCDC85V1 exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free Pegasystems PEGAPCDC85V1 Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your Pegasystems PEGAPCDC85V1 exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free Pegasystems PEGAPCDC85V1 Dumps

Practice These Free Questions and Answers to Pass the Pega Decisioning Consultant Exam

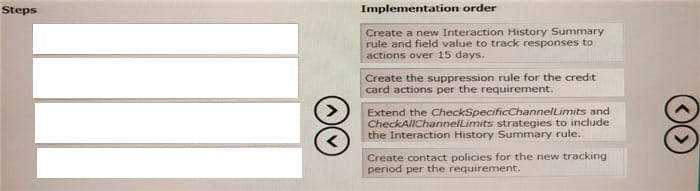

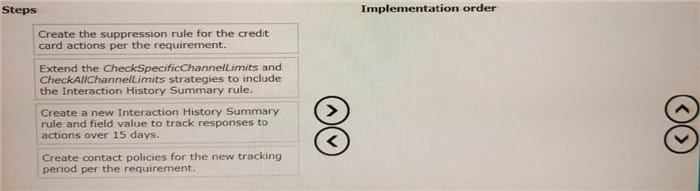

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within

15 days.

Put the steps in the correct order to implement this task.

Select and Place:

U+ Bank, a retail bank, has introduced a credit cards group with Gold card and Platinum card offers. The bank wants to present these two offers based on the following criteria:

1.

For both cards, customers must be above the age of 18

2.

Offer both cards only if the customer does not explicitly opt-out of any direct marketing for credit cards

3.

Platinum card is suitable for customers with the Credit Score > 500

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

Hot Area:

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

A. Volume constraints

B. Customer contact limits

C. Suitability rules

D. Suppression policies

U+ Bank, a retail bank, uses Pega Customer Decision HubTM for their one-to-one customer engagement. The bank now wants to change its offer prioritization to consider both business objectives and customer needs.

Which two factors do you configure in the Next-Best-Action Designer to implement this change? (Choose Two)

A. Business levers

B. Engagement policies

C. Context weighting

D. Contact policies

Myco, a telecom company, has recently implemented Pega Customer Decision HubTM. Now, the company wants to move away from traditional marketing and leverage the always-on outbound capabilities.

What artifact do you configure to translate the traditional segments used to identify the target audience?

A. Engagement policies and Arbitration

B. Contact policies

C. Segmentation

D. Audience

Viewing Page 3 of 3 pages. Download PDF or Software version with 60 questions