CPA-TEST Exam Questions & Answers

Exam Code: CPA-TEST

Exam Name: Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, Regulation

Updated:

Q&As: 1241

At Passcerty.com, we pride ourselves on the comprehensive nature of our CPA-TEST exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free AICPA CPA-TEST Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your AICPA CPA-TEST exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free AICPA CPA-TEST Dumps

Practice These Free Questions and Answers to Pass the AICPA Certifications Exam

When an auditor qualifies an opinion because of inadequate disclosure, the auditor should describe the

nature of the omission in a separate explanatory paragraph and modify the:

A. Option A

B. Option B

C. Option C

D. Option D

Which of the following activities would most likely be considered an attestation engagement?

A. Consulting with management representatives of a firm to provide advice.

B. Issuing a report about a firm's compliance with laws and regulations.

C. Advocating a client's position on tax matters that are being reviewed by the IRS.

D. Preparing a client's tax returns.

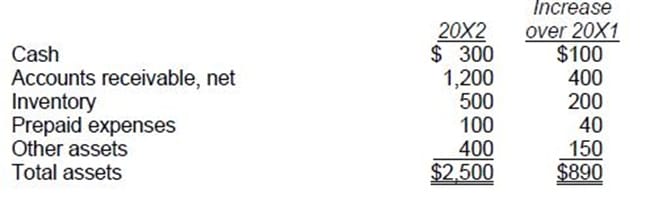

At December 31, 20X2, ABC Co. had the following balances in selected asset accounts:

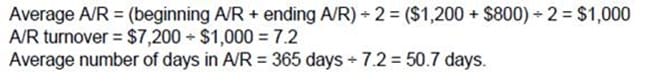

ABC also had current liabilities of $1,000 at December 31, 20X2, and net credit sales of $7,200 for the year

then ended.

What was the average number of days to collect ABC's accounts receivable during 20X2?

A. 30.4

B. 40.6

C. 50.7

D. 60.8

Using microcomputers in auditing may affect the methods used to review the work of staff assistants because:

A. The audit fieldwork standards for supervision may differ.

B. Documenting the supervisory review may require assistance of consulting services personnel.

C. Supervisory personnel may not have an understanding of the capabilities and limitations of microcomputers.

D. Audit documentation may not contain readily observable details of calculations.

ABC, Inc. is interested in measuring its overall cost of capital and has gathered the following data. Under the terms described below, the company can sell unlimited amounts of all instruments.

•

ABC can raise cash by selling $1,000, 8 percent, 20-year bonds with annual interest payments. In selling

the issue, an average premium of $30 per bond would be received, and the firm must pay floatation costs

of $30 per bond. The after-tax cost of funds is estimated to be 4.8 percent.

•

ABC can sell 8 percent preferred stock at par value, $105 per share. The cost of issuing and selling the

preferred stock is expected to be $5 per share.

•

ABC’ common stock is currently selling for $100 per share. The firm expects to pay cash dividends of $7

per share next year, and the dividends are expected to remain constant. The stock will have to be

underpriced by $3 per share, and floatation costs are expected to amount to $5 per share.

•

ABC expects to have available $100,000 of retained earnings in the coming year; once these retained

earnings are exhausted, the firm will use new common stock as the form of common stock equity

financing.

•

ABC’ preferred capital structure is:

Long-term debt 30%

Preferred stock 20

Common stock 50

If ABC, Inc. needs a total of $1,000,000, the firm's weighted-average cost of capital would be:

A. 6.8 percent.

B. 4.8 percent.

C. 6.5 percent.

D. 9.1 percent.

Viewing Page 3 of 3 pages. Download PDF or Software version with 1241 questions