CPA-REGULATION Exam Questions & Answers

Exam Code: CPA-REGULATION

Exam Name: CPA Regulation

Updated: May 09, 2024

Q&As: 69

At Passcerty.com, we pride ourselves on the comprehensive nature of our CPA-REGULATION exam dumps, designed meticulously to encompass all key topics and nuances you might encounter during the real examination. Regular updates are a cornerstone of our service, ensuring that our dedicated users always have their hands on the most recent and relevant Q&A dumps. Behind every meticulously curated question and answer lies the hard work of our seasoned team of experts, who bring years of experience and knowledge into crafting these premium materials. And while we are invested in offering top-notch content, we also believe in empowering our community. As a token of our commitment to your success, we're delighted to offer a substantial portion of our resources for free practice. We invite you to make the most of the following content, and wish you every success in your endeavors.

Download Free Test Prep CPA-REGULATION Demo

Experience Passcerty.com exam material in PDF version.

Simply submit your e-mail address below to get started with our PDF real exam demo of your Test Prep CPA-REGULATION exam.

![]() Instant download

Instant download

![]() Latest update demo according to real exam

Latest update demo according to real exam

* Our demo shows only a few questions from your selected exam for evaluating purposes

Free Test Prep CPA-REGULATION Dumps

Practice These Free Questions and Answers to Pass the Test Prep Certifications Exam

Adams owns a second residence that is used for both personal and rental purposes. During 2001, Adams used the second residence for 50 days and rented the residence for 200 days. Which of the following statements is correct?

A. Depreciation may not be deducted on the property under any circumstances.

B. A rental loss may be deducted if rental-related expenses exceed rental income.

C. Utilities and maintenance on the property must be divided between personal and rental use.

D. All mortgage interest and taxes on the property will be deducted to determine the property's net income or loss.

On February 1, 1993, Hall learned that he was bequeathed 500 shares of common stock under his father's will. Hall's father had paid $2,500 for the stock in 1990. Fair market value of the stock on February 1, 1993, the date of his father's death, was $4,000 and had increased to $5,500 six months later. The executor of the estate elected the alternate valuation date for estate tax purposes. Hall sold the stock for $4,500 on June 1, 1993, the date that the executor distributed the stock to him. How much income should Hall include in his 1993 individual income tax return for the inheritance of the 500 shares of stock, which he received from his father's estate?

A. $5,500

B. $4,000

C. $2,500 D. $0

Which one of the following will result in an accruable expense for an accrual-basis taxpayer?

A. An invoice dated prior to year end but the repair completed after year end.

B. A repair completed prior to year end but not invoiced.

C. A repair completed prior to year end and paid upon completion.

D. A signed contract for repair work to be done and the work is to be completed at a later date.

Capital assets include:

A. A corporation's accounts receivable from the sale of its inventory.

B. Seven-year MACRS property used in a corporation's trade or business.

C. A manufacturing company's investment in U.S. Treasury bonds.

D. A corporate real estate developer's unimproved land that is to be subdivided to build homes, which will be sold to customers.

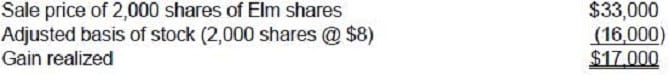

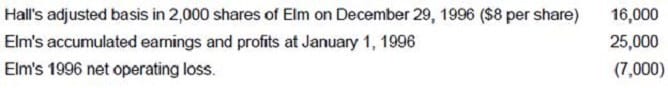

Elm Corp. is an accrual-basis calendar-year C corporation with 100,000 shares of voting common stock issued and outstanding as of December 28, 1996. On Friday, December 29, 1996, Hall surrendered 2,000 shares of Elm stock to Elm in exchange for $33,000 cash. Hall had no direct or indirect interest in Elm after the stock surrender. Additional information follows:

What amount of income did Hall recognize from the stock surrender?

A. $33,000 dividend.

B. $25,000 dividend.

C. $18,000 capital gain.

D. $17,000 capital gain.

Viewing Page 2 of 3 pages. Download PDF or Software version with 69 questions